How does your super balance compare with other people your age?

And in today's newspapers, 'Why these are the four biggest barriers to a secure retirement'?

In this edition

Course: The countdown to kickoff is on - last call on Earlybird pricing

Feature: How does your super balance compare with other people your age?

From Bec’s Desk: Short and sweet

SMH/TheAge: Why these are the four biggest barriers to a secure retirement

Prime Time: How women can increase their healthspan with Maddy Dychtwald

Summer Flagship Course - Earlybird 25% off deal closing soon

Our Summer Edition of the How to Have an Epic Retirement Flagship Course is now open for booking. There’s a 25% early bird discount bringing the price down to $359 but that deal ends this Wednesday.

This is the last course for 2024. We won’t be hosting another until late in Feb 2025.

Want to learn more or download the brochure?

➡️ visit the website here or ➡️ book your place here

Here’s a lovely testimonial that came in this week from our Spring Program:

“I have gone from a person who thought retirement was something to fear to someone who has realised it is a time to enjoy life with a little thought, planning and preparation. I now think an Epic Retirement is actually possible. Retirement is not retiring from life it is a new way of living.” — Kenneth R.

How does your super balance compare with other people your age?

Ever wondered how your superannuation balance stacks up compared to others your age? Or how much you 'should' have to stay on track for a comfortable retirement? Well, I’ve done some digging to give you a better understanding of super balances by age—and hopefully, this inspires you to take a closer look at your own super. Understanding your super, knowing how to grow it before retirement, and making smart decisions on how to use it during retirement are all key to a financially secure future.

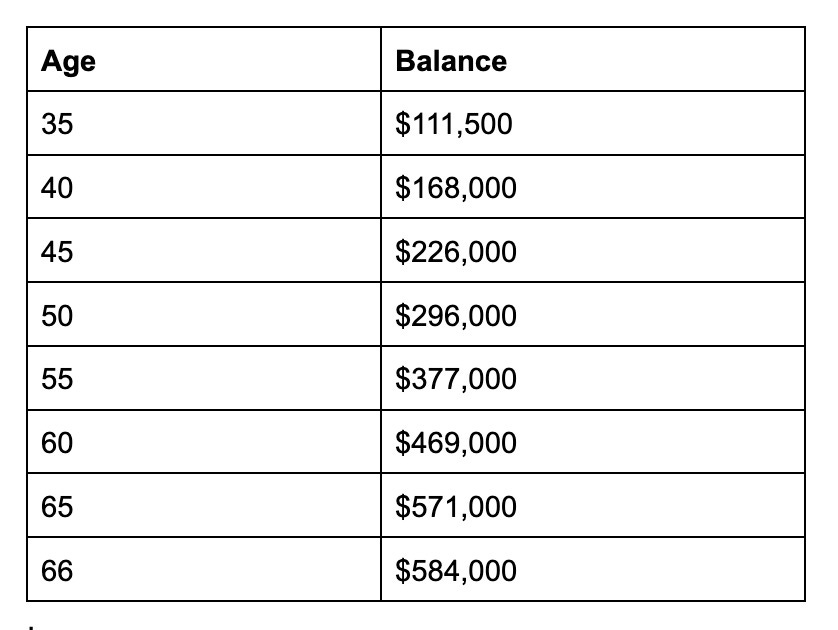

Average balances of Australians

The ATO released data on average super balances by age and gender a few years ago. While this data dates back to 2021, it still provides a good snapshot of where people are at different stages in life. Take a look below, and compare your balance to the national averages.

You might be looking at your super statement right now, either feeling frustrated or pleasantly surprised by how your balance compares to these averages. It’s important to remember that very few people are truly 'average' when it comes to super, and there are a lot of factors that can influence your balance.

Maybe you took time out of the workforce for family or other reasons, or you’ve chosen a lower-risk investment strategy that has grown more slowly over time. On the flip side, if you’ve earned a higher income throughout your career, made extra contributions, or invested in higher-growth options, you might find your balance sits above the average.

Understand how much you need

The Association of Superannuation Funds of Australia (ASFA) provides benchmarks for a comfortable retirement. They estimate that:

A couple needs around $690,000 in super and to own their home outright to generate an annual income of approximately $73,337 (from both super and the age pension).

A single person would need $595,000 in super for an annual income of $52,085, assuming they also own their home outright.

If you're aiming for a more modest retirement, ASFA suggests that both singles and couples need around $100,000 in super. At this level, you’re likely eligible for the full age pension, which, combined with your super, could provide an income of $47,731 for couples or $33,134 for singles.

Are Australians hitting the targets?

According to Census data, around 45,000 Australians aged 60 to 64 retire each year, with even more in the 65 to 69 age group (65,000). The reality is that many Australians are not meeting the benchmarks for a comfortable retirement, especially those retiring as individuals rather than as part of a couple.

How are you tracking?

Now’s the perfect time to check your balance and see if you’re on track for a comfortable retirement. If you're curious about where your super should be by midlife to hit those comfortable retirement targets, ASFA has some helpful guidelines.

I used their Super Balance Detective to give you an idea of where your balance should be if you’re aiming to retire at 67. This is a good way to see if you’re tracking well or if it might be time to make some adjustments—whether that’s contributing more, reviewing your investment options, or even seeking professional advice.

And what if you aren’t tracking well?

If your super balance is looking lower than the target, it could be time to take some more proactive steps to understand it better, and learn more about how you can grow your balance for retirement. There’s plenty of steps in the book - in the section on superannuation and investing - buy your copy here.

I’m just back on deck from a week away in the Whitsundays with my family! Bliss. Thanks for your patience - I’m back into things with a thud this week! In fact this week we’re gearing up for the next How to Have an Epic Retirement Flagship Course - just 11 days until kickoff. And, I’m speechwriting - I’ve got a bit of travelling to do this month - to speak - something I love doing!

I’ve also got a book to finish! The book’s deadline is just 3 weeks away! So this update is short and sweet! I’m saving my words!

If you haven’t already - make sure you have a listen to Maddy Dychtwald on the Prime Time podcast. I’ve been following Maddy’s work for decades. She’s one of the real world leaders on modern ageing trends - so her new book, Ageless Aging shot up the bestseller list in the US when it was released in recent months and it’s finally just dropped in Australia. A great read and she shares so many good insights for women.

—

Catch you next week! Keep sending me your letters! Some of them have given me real inspiration for the book! Please, send them to bec@epicretirement.com.au.

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

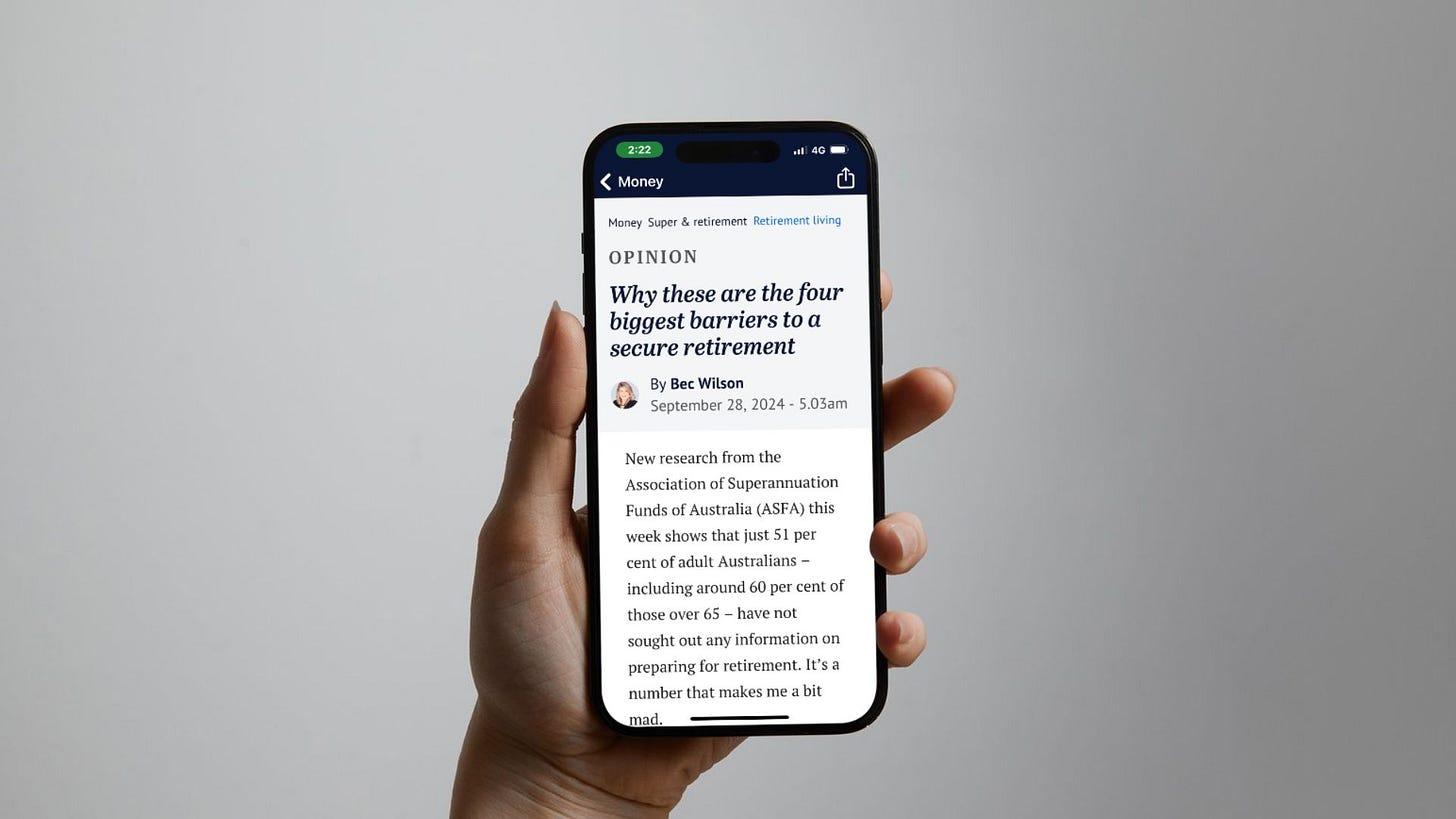

Why these are the four biggest barriers to a secure retirement

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 30th September 2024.

New research from the Association of Superannuation Funds of Australia (ASFA) this week shows that just 51 per cent of adult Australians – including around 60 per cent of those over 65 – have not sought out any information on preparing for retirement. It’s a number that makes me a bit mad.

According to the ASFA survey, 21 per cent of people have accessed financial advice; another 21 per cent got their information from friends and family; 15 per cent used online calculators; and 12 per cent sought advice from their super fund. Only 8 per cent turned to media articles, and a mere 6 per cent found advice via social media.

Let’s unpack this problem. Because to fix it, we need to solve a few different issues.

First, we need to help people better understand and engage with what their future retirement could look like so that they’re motivated to seek out advice. Then, we must ensure that the advice they’re getting is both affordable and trustworthy – and truly in their best interest.

So, the way I see it, there are four big problems to tackle:

1. Engagement – getting people interested in planning for retirement.

Most people don’t really start thinking about how much money they’ll need in retirement until it’s right around the corner.

And let’s face it, retirement can be a polarising topic. Some people can’t wait to retire – they see how it fits into their life from their late forties or early fifties and are already planning everything possible to get there faster. These folks actively seek out the information they need. They’re the easy ones to help with education and advice.

Others never want to retire, especially those who find deep fulfilment in their work. The thing is, no one tells them they can keep working and still access part of their retirement savings to enjoy a more flexible lifestyle while continuing the work they love.

Then there’s the third group — the ones who believe they’ll never have enough saved for a comfortable retirement. The fear of seeing their financial reality drives them to avoid superannuation statements, planning, and even the thought of retirement altogether.

But imagine if we could strip away that fear, show them that the system is designed to help them, and explain that understanding their retirement options earlier is actually empowering.

2. Affordable, trustworthy advice. The average financial adviser manages around 100 clients, and we currently have about 15,600 independent advisers in Australia. Yet, advisers are still leaving the industry, meaning only around 156,000 people can get retirement advice from an independent adviser right now.

This article continues. Read on, in The Age, The Sydney Morning Herald, Brisbane Times, WA Today.

How women can increase their healthspan with Maddy Dychtwald

This week we’re chatting with internationally renowned and bestselling author, Maddy Dychtwald, the author of the new book ‘Ageless Aging’. Her new book is a guide for women on how to increase their healthspan.

It’s a new book for women which shot up the USA Today and New York Times bestseller list when it was released in the US earlier this year.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Last of all, if you haven’t read the book, you can order your copy from Amazon online and Big W online too. Or pick up a copy at your local Big W, or QBD stores.

Yes well I’m understandably at 46 you’ve got 21 years of work left in you. I am 64 and I doubt that I will ever have that much in super as I was. A mum stayed at home and then didn’t go to work until my youngest was 10. Also, if you’re getting paid very well and not a single mother you could probably do that as a single mother. It is very very difficult to do that.

I don’t understand how a woman according to the ATO can possibly have $571,000 in their super at age 65 definitely wasn’t possible and isn’t possible with me or anyone I know.