Special edition: The top performing super funds in the retirement phase 2024

There’s simply no data in the public domain that benchmarks the performance of retirement phase funds. So here's some for you to consider.

In this edition:

Article: The highest performing superfunds in retirement phase

SMH/The Age: The best superfunds for when you retire

Prime Time: A podcast discussing the best superfunds for when you retire with Ian Fryer

From Bec’s Desk: No space!

Special edition: The top performing super funds in the retirement phase

Aussie retirees can't use public benchmarking to compare their retirement phase super fund's cost or performance. There’s simply no data in the public domain that benchmarks the performance of retirement phase funds investment returns or fees.

Today, I have a special edition of the Epic Retirement Newsletter for you. We're featuring exclusive data from research house Chant West on the performance of Australia's retirement-phase superannuation funds over both 10 years and 1 year for the financial year ending June 2024. This will help you review how your fund is performing in the retirement phase and assess whether you need to take action.

The terrific news is that retirement phase funds are outperforming accumulation phase funds handsomely. These key data points from Chant West tell the story.

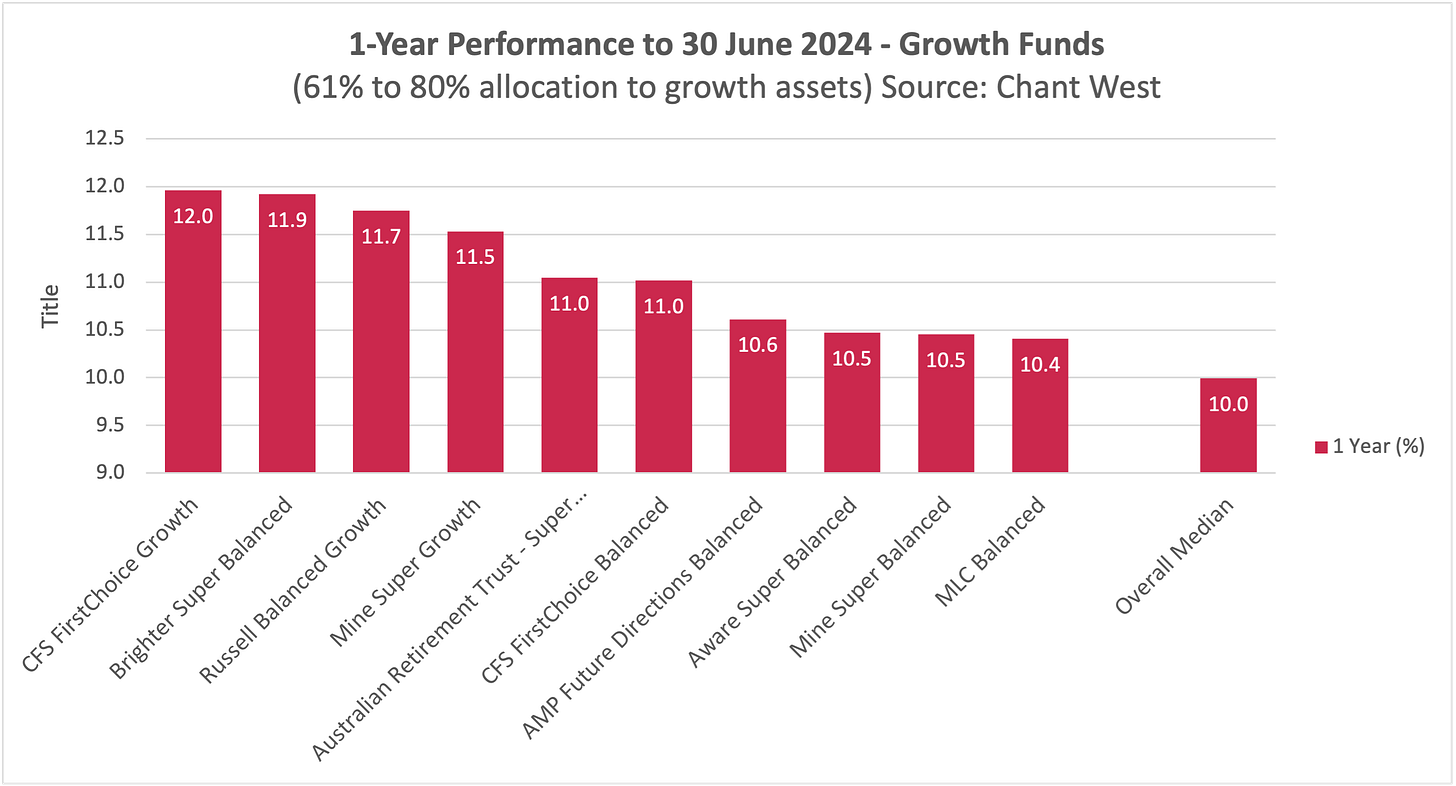

Performance of growth funds over 1 year:

Median 1 year performance of the top 10 growth funds in accumulation phase (61-80% growth assets): 9.1%

Median 1 year performance of the top 10 growth funds in the retirement phase (61-80% growth assets): 10%

Performance of growth funds over ten years:

Median 10 year performance of the top ten growth funds in accumulation phase(61-80% growth assets): 7.2%

Median 10 year performance of the top ten growth funds in retirement phase (61-80% growth assets): 5.8%

Performance of balanced funds over 1 year:

Median 1 year performance of the top 10 balanced funds in accumulation phase (41-60% growth assets): 7.4%

Median 1 year performance of the top 10 growth funds in the retirement phase (41-60% growth assets): 8%

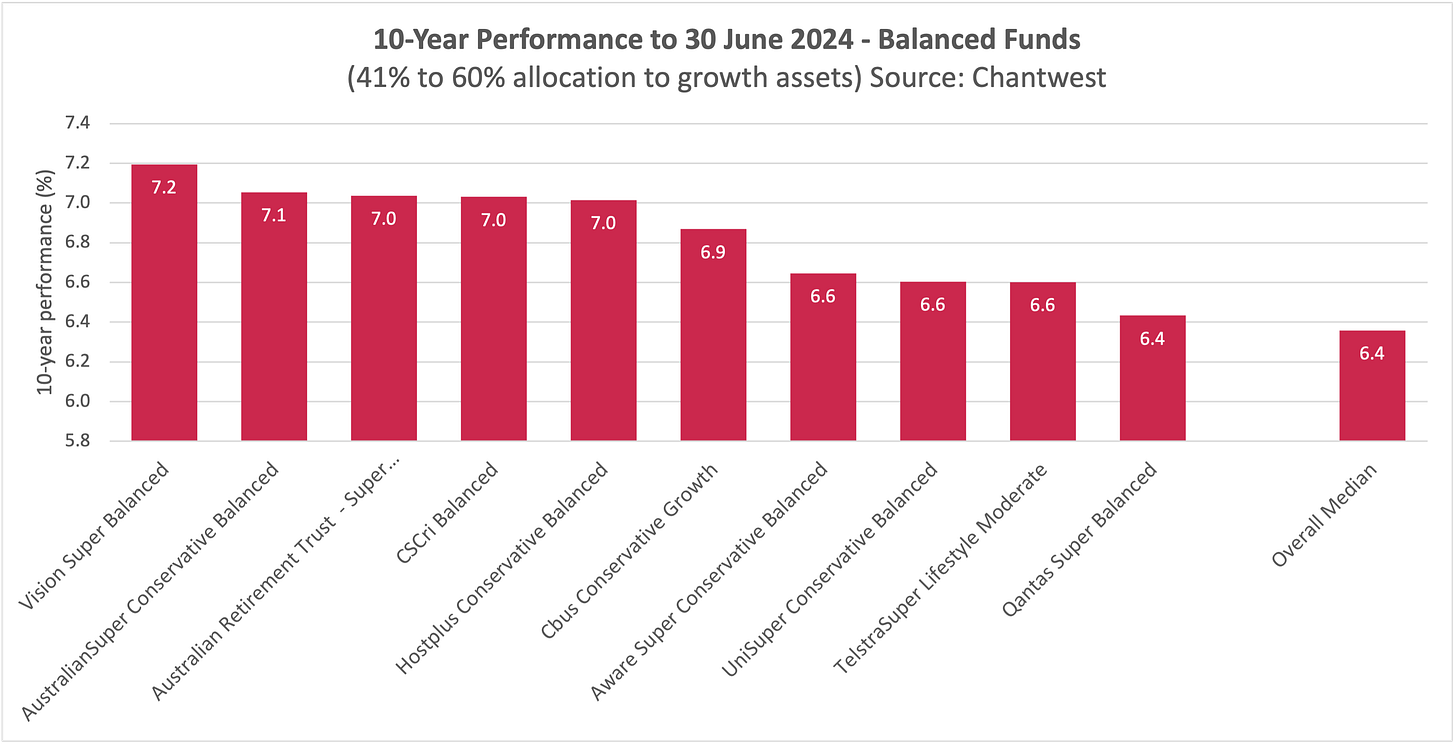

Performance of balanced funds over ten years:

Median 10 year performance of the top ten balanced funds in accumulation phase(41-60% growth assets): 8%

Median 10 year performance of the top ten balanced funds in retirement phase (41-60% growth assets): 6.4%

But there’s a lot more to talk about than the medians.

In the accumulation phase, the government offers a national benchmarking system called the YourSuper comparison tool - which is accessed via the ATO website. On this website you can compare the annual and long-term returns for ‘default’ (or standardised) superannuation products offered by all the superfunds.

In retirement phase, there’s simply no government benchmarks for assessing performance and fees. This makes it challenging for retirees to evaluate their retirement phase funds.

Most people don’t realise this. In fact, many people simply don’t understand how the retirement phase of super works at all.

What is the retirement phase of superannuation?

It might surprise you but there’s only 1.3 million people in Australia who have elected to join the retirement phase of superannuation, even though there’s more than 4.2 million people who call themselves retired in the census today. That means millions of people are electing not to draw down their superannuation as a tax-free income stream. Many of these people simply don’t understand how it works. Some have decided that it’s not right for them.

The retirement phase of superannuation is something you have to kick off with your superannuation fund by filling out a form, and opening a retirement phase account. To qualify for the retirement phase, you need to meet the conditions of release, and there’s two to consider, depending on your age.

You can access your super once you reach the ‘preservation age’ (now 60 for all Australians) and retire from your job. (Note - you can commence other work after).

Or, you can access your super and keep working unconditionally from the age of 65.

Once you enter the retirement phase, your superannuation is income tax and capital gains tax free, saving most people about 15% in tax in comparison to the accumulation phase. This is then seen in the performance metrics of superannuation funds, which have a like-for-like higher performance in the retirement phase, simply due to the tax free status of the members.

How do you define good performance?

Superannuation is a long term investment. It is a system designed to encourage you to save money in the accumulation phase, invest it well in good long term investment options, with low fees and watch your money grow through compound investing. Then, when you retire, you move it into the retirement phase, re-evaluate your risk profile now that you rely on it for income, and start to draw down. You can draw down in three core ways - using an account based pension (income stream); an annuity; or a lump sum.

Once you enter the retirement phase, you have to drawdown a percentage of your balance every year, based on your age.

Most people only change superannuation funds a couple of times in their lifetime, and only if their fund is not achieving their goals. When we evaluate funds we need to look at the things that really impact us:

The investment performance of the fund: When we consider the investment performance of our fund, we need to ensure we are comparing apples with apples. We need to know whether we are in a growth or a balanced fund, and how that specific investment is performing versus the competition over the long term - a ten year window is a good benchmark to consider. You can also look at the one year numbers - chiefly for entertainment to see who has done well in the year just gone, but always remember that a fund can strike it lucky in one year, but holding consistent, long term returns is what we are all here for.

The fees you are paying: The fees you are paying your fund are fundamental to consider, and they are often difficult to benchmark because there is so many different line items on a statement and so many differences to the way they are charged. When you look closely, a fund usually divides their fees out into two categories: administration fees and investment fees. We need to look at the total of both to benchmark our funds properly. Always exclude insurance when considering your fees as these are specific to your policy choices. You’ll also need to be cognisant of comparing your fees on the same sized balances as fees are usually lower on higher balances as there is usually a fixed component for administration and a variable component for investment costs that scales with the balance.

We have benchmarked the fees this year for the growth option, so you can see the administration fees, the investment fees and the total fees on the top ten performers - for a bit of insight.

So, to understand whether your fund is performing, you need to look at the long term performance, the fees they are charging as a percentage of your balance. You also need to consider the services they offer you as a member in my opinion.

Now let’s talk about the performance of funds this year, and over the last ten years, and explore who the real high-performers are.

We’ve gathered the data on the two most popular asset allocations:

GROWTH - which represents funds with a 61-80% allocation to growth assets; and

BALANCED - which represents funds with a 41-60% alloocation to growth assets.

The data on performance shows performance below shows net of investment fees over 10 years and 1 year at 30 June 2024.

One year investment horizon

In 2023/24 there’s been a real changing of the guard in which funds are outperforming on a one-year basis. This time last year eight of the top ten growth funds on the 1 year performance chart were industry funds. This year there’s just two industry funds in the top ten.

Growth

Balanced

Ten year investment horizon

The ten year performance metrics tell a very different story to the one-year. The top ten performing funds over the last ten years has not changed much in the twelve month. Our highest performing super funds over the longer term have continued to hold onto their top positions as best performing funds, with just a little bit of movement between positions.

Growth

Balanced

Fees

Super funds usually report their performance and charges annually on your statement. They are required to publicly report the fees on their default accumulation funds on the YourSuper website.

The most important lesson on fees that I can give you in the retirement phase is to evaluate your fund’s investment returns net of the investment fees - that is, remove them from the total returns. If your fund is charging a big fee to manage the investments but getting you a great return on your investment net of fees - what do you care? Applaud them.

The fee you really need to keep an eye on and benchmark is the administration fees. To work this out I recommend you add together all administrative fees from your fund and calculate the percentage fee relative to your account balance. By doing so, you can gauge how your fees compare to the norm.

Many funds impose fees as a fixed dollar amount, regardless of your account's size. Generally, as your account balance increases, your fee as a percentage of the total balance should decrease.

Chant West have provided the data on the fees as a percentage of the balance for growth funds with a balance of $250,000, the median balance for Australians at retirement today.

Thinking about your risk appetite in retirement

As shown in the data above, I've provided two levels of risk in the benchmarks. This is because, as we enter retirement, many people's risk appetites change. They often shift from being eager to embrace risk and reward to being more cautious about market downside risk. Take some time as you head into retirement to consider whether you want to remain heavily exposed to growth assets or adopt a more balanced approach. There’s no right answer—only your answer. Consulting with a financial planner can also provide valuable insights.

Knowing the performance of funds, what actions should you take?

If you want to take a deeper dive into your retirement phase superannuation’s performance and fees, here are three essential steps:

Review your own superannuation statement:

Compare your fund's returns against the ten-year returns for balanced funds if your fund has 41-60% growth assets, or growth funds if your fund has 61-80% growth assets.

Look harder at the fees:

The fees that really matter if you’re watching them are the administration fees. Most funds have these under control these days - but keep an eye on them for good measure. Compare these fees with those charged by the top ten companies with similar account balances to see if yours is on par, lower, or much higher.

Assess your risk appetite:

Consider whether your current risk appetite is suitable for your life stage and goals. Adjust your investment strategy if necessary.

If you're uncertain, seek financial advice from your super fund or an independent financial adviser.

The best superfunds for when you retire

Extract of article published in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 11th August 2024.

The data is in on the best performing superfunds for the year ending 30 June 2024. We know, from widespread media reports, that the top ten accumulation phase funds holding 61-80% in growth assets saw a median one year performance of 9.1% and the top ten funds holding 41-60% in growth assets, called balanced funds, saw an average of 7.4% returns in the accumulation phase. And that over 10 years, the top ten growth funds in the accumulation phase averaged 7.2% and the top ten balanced funds averaged 5.8%.

But what noone is talking about is how retirement phase funds performed over the same period and over the longer term. It’s like retirees don’t exist in the superannuation conversation. But they do. There’s nearly 5 million people at retirement age in Australia, so, talking about how their super funds are performing and what good looks like is quite an important conversation. Today the analysts at Chant West, one of Australia’s superfund analysts have helped me to take a deeper look at the performance of retirement phase funds. And the numbers are exciting.

This article continues…

Read the rest of this article in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 11th August 2024. It also appears in the print editions today.

The best superfunds for when you retire with Ian Fryer

In retirement phase, there’s simply no government benchmarks for reviewing the performance of your superannuation fund and the fees they charge. This makes it challenging for retirees to evaluate whether their retirement phase funds really are performing. So this week we’re talking to Ian Fryer from super-industry research firm, Chant West about the best performing funds in the 2023/24 financial year.

We talk about the investment returns of the best performing funds over 1 year and 10 year horizons. And, we talk about how you should be evaluating your fund’s performance with this information.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

This special edition is already longer than I’d wanted, so I’ll be brief! The How to Have an Epic Retirement Flagship Course for Spring has kicked off! Such a delight to see everyone’s enthusiasm in our education platform, chatting away in the forum, commenting on the lesson videos about how much they are learning. I think the power of structured education that flows lesson-by-lesson is something really appreciated by those of us who learned that way throughout our lives. I love delivering it, knowing people come out so much more confident than they went in! There will only be one more program this year. Register your interest on the form on our website.

I’ve been writing, writing and writing some more on the Prime Time book and there’s still so much more to write. It’s really taking a shape that I’m excited about, explaining this new stage of life in a way that I can’t find explained anywhere. Thanks to all the experts who have been lending me data, insights and expertise. ❣️

Our Facebook group The Epic Retirement Club has powered through 70,000 members (yes! really!) and the conversations are mind-blowing. Thanks for getting in and making it awesome, safe and fun.

I’m gearing up to do the Tassie trek through the Three Capes as I told you. I’m training a little - could be doing a lot more I think, so I’ll up my game next week. Less than a month til I head off. And I’m loving getting letters from those who’ve done it! So inspiring. I want to become a walking-holiday regular - for my own midlife adventures.

Have a great week ahead. You can always email me at bec@epicretirement.com.au. Until next week… make it epic!

Many thanks! Bec Wilson

Author, podcaster, guest speaker, retirement educator … Visit my website for more info about me, here.