Retirement isn't a product or a service, it's a project

And in today's newspapers, 'Retirement at 70? It’s coming, whether we like it or not'

In this week’s edition:

Feature: Retirement isn't a product or a service, it's a project

Newspapers: Retirement at 70? It’s coming, whether we like it or not

Podcast: Finding your new rhythm

From Bec’s Desk: In a little dark room

Retirement isn’t a product or a service. It’s a project.

For a long time, retirement was treated like a product - something you bought into, something delivered neatly at a set age (often by your financial adviser or a super fund). You handed over your paperwork, drew out a lump sum, set up your account based pension, and quietly exited the stage.

But that idea doesn’t fit anymore. Not for this generation.

Retirement today isn’t something that happens to you, or you can be ‘told how to do it’. It’s something you build. And that takes time, thought, and learning - because there’s no one-size-fits-all pathway anymore.

We don’t talk about this enough: entering retirement is stepping through a transition into a whole new stage of life, not an end point. And just like any big life change, it deserves space, curiosity, and creativity.

Some people approach it like a second or third stage of their career. Others use it to explore parts of themselves they’ve put on hold for years or have never really taken time for. Many are still working out what they want it to look like - and that’s okay.

Because the truth is, the best retirements aren’t scripted. They’re shaped.

That’s why I think we need a new way of thinking about this chapter. Not just as the winding-down years - but as a phase with depth, with decisions, and with potential.

Retirement isn’t a product to buy or a process you have have an adviser do for you. It’s a project to shape. And the best years of your life might just be the ones you haven’t lived yet.

Think of retirement not as a finish line, but as a design project.

Then ask yourself three questions:

What do I want my days to look like?

What do I want to keep doing - and what am I ready to let go of?

What will give me a sense of meaning, challenge, or bring me personal joy in this next chapter?

You don’t need all the answers. You just need to start asking the important questions.

Because once you shift from “retiring from” to “retiring into,” the whole thing opens up. That’s where the magic starts! Make it epic!

The How to Have an Epic Retirement Flagship Course is back for August kickoff! And the Earlybird 25% off won’t last!

This 6-week program has helped thousands of Aussies get retirement-ready - with smart strategies for money, time, health, happiness and purpose, travel and your home as you age.

🎟️ The 25% off early bird spots are now open and they’re filling up quickly. So get in and lock down your place at this price.

👉 Check it out here and download the new brochure for Spring 2025

Let’s make your retirement epic.

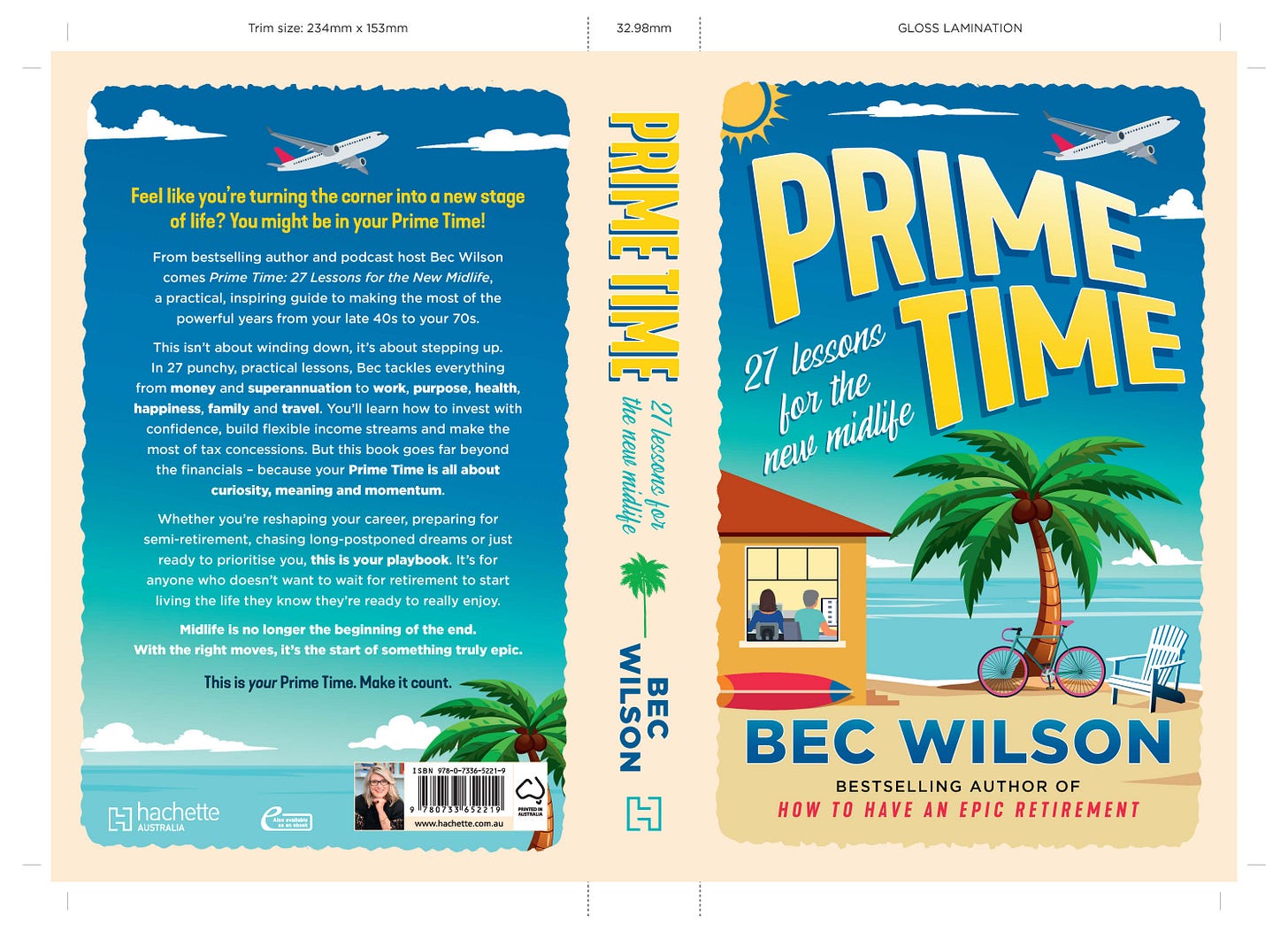

Well, I’ve spent most of this week in a little dark room (a professional studio), reading Prime Time aloud into a microphone for the audiobook. It’s slow going (and a bit of a vocal marathon), but I secretly love the shift in pace. I’ll be doing that every night this week—four to five hours of reading out loud a day is more than enough, thank you very much.

The book itself—the one that never seemed to stop being edited—is finally locked and off to print. I saw the final cover this week, complete with the back-cover blurb. Very exciting. We’re counting down now to launch day: 30 July. Just two months to go.

You can pre-order your copy on Amazon here or Booktopia here, and I’d be so grateful if you did—it genuinely helps the retailers get behind the book. I’ll be dropping into Booktopia in Sydney the week before release to sign all their pre-orders, so if you want a signed one, that’s the way to go.

Meanwhile, our Facebook Group—The Epic Retirement Club—is absolutely booming. It’s on track to hit 400,000 worldwide members this weekend. We’ve got an incredible team of 19 volunteer moderators around the world keeping the conversation thoughtful, kind, and high quality.

There’s no financial advice flying around in there—just real people sharing real stories about how they’re navigating their Prime Time and Epic Retirement years. It’s the most honest, inspiring window into what retirement really looks like. I’m constantly blown away by the generosity and wisdom in the group. If you haven’t joined yet, come take a look.

And if you’re thinking about joining us for the next course — which I’m really excited for — The Spring Edition of the How to Have an Epic Retirement Flagship Course- don’t wait too long. The 25% Earlybird Deal is booking up fast, and the course kicks off on 28 August. 👉 More info here

Until next week, from the small dark room

Bec

Got thoughts this week — send an email to bec@epciretirement.net. I read every one.

Cheers, Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Retirement at 70? It’s coming, whether we like it or not

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 1 June 2025.

This week, Denmark did something bold, and frankly, confronting. It locked in a plan to lift its state pension age to 70 by 2040. Not a proposal. Not a think tank idea. Actual law.

Seventy. Let that sink in.

It’s the kind of move that makes people everywhere shift in their seats. Because if Denmark can do it, so can we. And whether we like it or not, the ripple effect is coming.

In Denmark, “retirement age” means the age you can access the state pension, their version of our age pension. It’s currently 67. It’ll rise to 68 by 2030, and then 70 by 2040, when today’s 55-year-olds hit that milestone. It’s been legislated in line with life expectancy – so as people live longer, the pension age just rises. Automatically – no political debate required, and no elections lost to the shift.

The message is clear: you’ll still get support, but not until much later in life. Want to retire earlier? That’s on you. You’ll need your own savings to bridge the gap.

That’s precisely what many Danes are preparing for – because while the state pension won’t kick in until 70, many private and workplace pensions can still be accessed from around age 60 or 62.

Expect more pressure to plan your own income, not less. Denmark had the guts to say it out loud. I’m not sure Australia’s ready to.

People who want to stop working earlier can do so, but they’ll need to rely on their own savings for a longer period before the state support begins. Bridging that gap is now a personal responsibility.

The Danish system looks generous, but it’s designed to be fair, not cushy - though many Australian pensioners might think otherwise. If you’ve lived in Denmark for 40 years between age 15 and retirement, you’re entitled to the full public pension. Less than that, and you receive a proportional amount. And it’s no small sum.

The full Danish folkepension pays around AUD $57,000 a year, but after tax, most retirees take home between roughly AUD $40,000 and $42,000. That includes a base pension, which everyone gets, and a supplement, which is means-tested. About half the payment is universal; the rest tapers off if you have higher income from savings or investments.

(READ ON… my articles are never paywalled for Aussies in The Age, The Sydney Morning Herald. )

In this soul-stirring episode of Prime Time, I am joined by retirement coach John Glass from 64 Plus for a powerful, heartfelt conversation about the emotional shifts and lifestyle reinvention that come with retirement. We explore how to build a meaningful, purpose-driven life after work—one that’s full of connection, curiosity, and clarity.

Together, we unpack the emotional roadblocks many people face when the structure of full-time work disappears—from loss of identity to fear of irrelevance—and how to replace them with daily rhythms that support wellbeing, purpose, and joy. From cartooning and language learning to rose gardening and gym rituals, Bec and John reveal what it really means to craft a “portfolio life” in retirement.

Plus, I chat with Kat McPhee from Aware Super about what to do when life throws a financial curveball your way. Whether you're forced to retire early, navigating Centrelink, or just trying to feel financially confident, this segment is full of reassuring, practical advice.

This episode is a must-listen for anyone wondering: What’s next? And How do I make it count?

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

Well I'm a 60 year old tradesman and I have difficulty doing some aspects of my job now. I've recently had to get younger members of our company to do some jobs because I couldn't physically do it. Trying to my job at 70, I very much doubt I could. And if I could, the chances of having an accident would be greatly increased. Not everyone gets to do their work in a comfortable office chair.

Exactly. I have taken a project management approach to planning ny retirement and won't stop once I pull the pin on paid work in a few months time.