Can ChatGPT help you plan your retirement for free?

Plus, in today's papers "To stop retirees going mad super funds must agree of on these three things"

In this week’s edition:

Feature: Can ChatGPT help you plan your retirement for free?

Newspapers: “To stop retirees going mad super funds must agree of on these three things”

Podcast: Take the plunge into solo travel with Fiona Dalton

From Bec’s Desk: Come on the journey

My new book arrives in stores this week.

I can’t quite believe it — Prime Time: 27 Lessons for the New Midlife hits the shelves in just three days.

If you’ve ever thought, “Surely life can get better from here, and I don’t have to wait for retirement’ this book is for you. It’s packed with the good stuff: easy-to-understand financial lessons; real talk about work, purpose and happiness; practical steps you can take, and a whole lot of encouragement.

If you haven’t ordered your copy yet, now’s the perfect time. Pre-orders really help get the book into more hands by starting the sales off with a bang (and hopefully seeing it hit the bestseller lists). I’d be so grateful if you grabbed yours.

Can ChatGPT help you plan your retirement for free?

I, like most people, have been using ChatGPT more and more lately - to help with, well… just about everything.

When my dog got really sick and I realised the vet was Googling treatments in front of me (while charging by the 15-minute block), I turned to ChatGPT. It helped me track his recovery and manage his rehab, step by step. And it was terrific where my vet left me hanging.

On my trip, I used ChatGPT to set our daily travel plans, and guide us on the things to do and she learnt quickly I hate crowded Eurosummer beaches packed with expensive sunloungers and redirected us to nice free and peaceful places instead.

Then, when I got back from holidays recently and wanted to up my game at the gym, I asked it to write me a program to build muscle and burn off the pasta and gelato. It nailed it.

It’s not always spot-on the first time - but ask the right questions and it gets sharper quite quickly.

So I thought - why not help you try it with retirement planning?

Not to replace good advice, but to build understanding, boost confidence, and help you learn faster. Because if you’ve ever felt in the dark about super, retirement income, or what life after work, or in your Prime Time might look like - this might just be your shortcut to getting yourself some more clarity.

So today I want to share with you three great prompts you might want to try, and how it answered the first one for Jess (a person I made up) who’s 54 right now, earns $90,000 per year and has $300,000 in super.

Prompt 1: Is Jess on track to retire at 67?

“Jess is 54 with $300,000 in super and earn $90,000 a year and plans to keep working full-time until 67. She salary sacrifices $100 a week into super. Estimate how much she might have in super by retirement, and what income that could give her, assuming 7.5% returns and 0.8% fees. Show the income in today’s dollars and include if I’d likely qualify for the Age Pension.”

Here’s what ChatGPT came back with:

“Estimated super at 67: ~$1,005,800

Annual retirement income (assuming 5% drawdown): ~$50,290

Likely Age Pension eligibility: Nil – her assets would be too high to qualify at first

Total annual income (in today’s dollars): ~$50,290

What this tells us: Jess is tracking well—especially considering many Australians enter retirement with far less. That $1 million balance gives her a decent base to draw from, and she may become eligible for a part pension later on as her balance reduces over time.

But beware: This is a straight-line projection. Life rarely goes in a straight line. So if Jess wants to explore part-time work in her early 60s, or a bigger travel budget for her first decade of retirement, she’ll want to model that too (and Prompts 2 and 3 can help).”

Checking the result

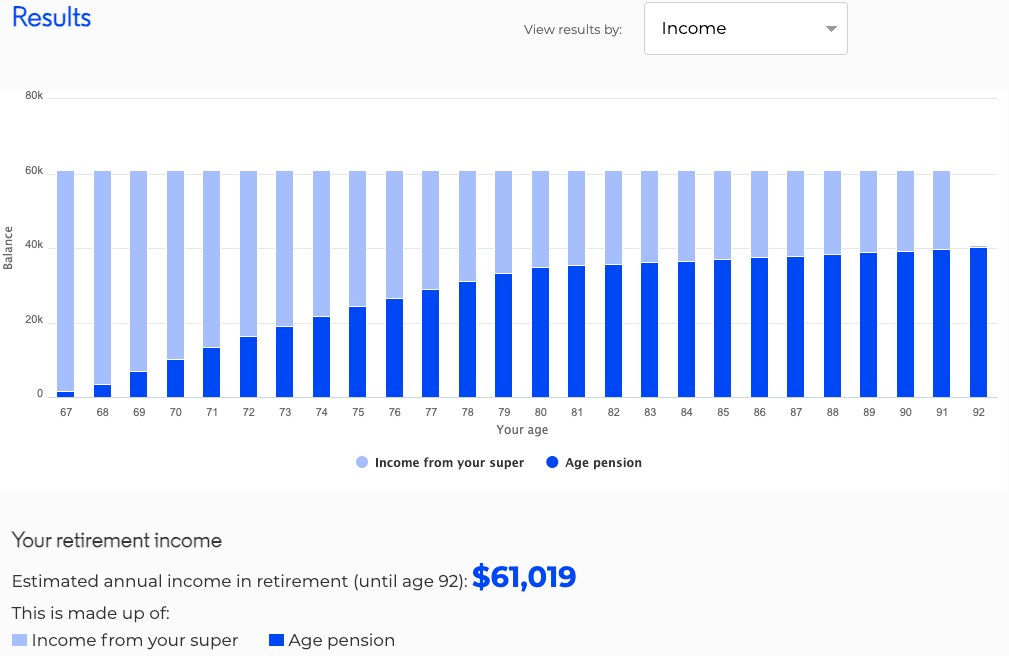

To check how the AI result compared, I ran the same metrics through the MoneySmart Retirement Planner. And this was the result:

Estimated annual income in retirement (until age 92): $61,019

Estimated super balance at retirement: $638,876

In contrast, the Moneysmart calculator, which also uses a 7.5% investment return before retirement, shows that Jess would qualify for a part pension on retirement. So - who do you believe?

Bec’s note:

I wanted to test how helpful ChatGPT really is when it comes to retirement planning. This was a simple, sensible prompt for Jess and it gave me a very clean, very confident answer. But then I ran the same scenario through the government’s MoneySmart Retirement Planner — and the results were… different.

The AI projected a $50,290 income in today’s dollars, based on drawing down 5% of her super annually, and said she wouldn’t qualify for the Age Pension at first. The Moneysmart tool showed an annual income of $61,019 and suggested she’d be eligible for a small part pension straight away.

Who’s right?

Well, both are using similar assumptions — like a 7.5% return before retirement — but they’re calculating differently. The AI used a flat drawdown model. Moneysmart models pension eligibility more accurately and adjusts for inflation over time.

The takeaway? ChatGPT is great at simplifying complex ideas, giving you a quick feel for how things might pan out. But it's not a full financial modelling tool. The magic really happens when you start asking smarter follow-up questions like:

“What happens if Jess goes part-time at 60?”

“When exactly would she become eligible for the pension?”

“How long would that income last if she lives to 95?”

I love it as a tool for learning and building financial confidence — but not for final decisions. That’s why I think playing with it is so valuable. You get clearer, faster, and more curious about your future.

Ready to try your own? Here are two more prompts worth playing with — and the results are fascinating. (No room in this newsletter for all the juicy detail… but you’ll see why it’s worth a go.)

Prompt 2: Can I go part-time at 60?

“If I want to go part-time at 60 and work 3 days a week earning $55,000, what super balance would I need by then to top up my income and still retire at 67 comfortably? Assume I’d like to maintain a total income of around $65,000 per year. Suggest a plan from now to 60 to make that happen.”

Then, I thought I’d get clever and bring in some of my very new Prime Time thinking.

Prompt 3: Give me a staged life plan for my Prime Time years

“Create a staged life plan for me from 54 to 70. Include goals and priorities for money, work, health and lifestyle. I don’t just want a retirement plan; I want a clear picture of how to make the most of these next 15 years, including when to travel more, when to shift work hours to part time, and how to stay financially confident.”

My verdict?

AI is shaping up to be an incredible tool for experimenting, sense-checking your plans, and building confidence in the dark. And let’s be honest — it’s a lot easier than wrestling with Excel, and it’s far better at explaining things clearly. It’s not always right, and it doesn’t always give you the detail until you dig for it — but if you know that, you’ll be cautious.

Will it replace what I do? I really hope not — unless it develops a personality, a decent sense of humour, and the ability to make super and retirement feel easy to understand. (In which case, I may need to start podcasting from a cave. 😉) What it might do is help streamline the advice industry’s workloads - and that’s not a bad thing.

In the meantime — I’ll keep writing books if you keep reading them and making courses if you keep attending. Deal?

It’s back! The Epic Retirement Flagship Course kicks off this August — and Earlybird is going to end this week🔥

If you’ve been thinking about getting serious about your epic retirement, time’s almost up to get 25% off. My 6-week How to Have an Epic Retirement Flagship Course has already helped thousands of Aussies set themselves up for a retirement that’s smart, secure, and actually fun - with real strategies for money, time, health, happiness, travel, and how to age well in your own home.

🎟️ Earlybird spots are still 25% off. But we’ll be closing off the deal this week.

👉 Check it out here and download the new brochure for Spring 2025

Let’s make your retirement epic.

I’m home — back from the Prime Time holiday of my dreams. And I’ve hit the ground running - fast.

First stop: Sydney, where I sat on the couch on the Today Show and talked about the book (nervewracking but I think I did a good job). And then I headed to my publisher’s office and signed hundreds of books for Booktopia’s presales orders.

After that, it was up to Noosa to launch Prime Time with a beautiful luncheon over the water at the Noosa Alive Festival. And finally, back to Brisbane just in time to appear on 7Sunrise on Saturday morning. In between there was a chat with Jess on ABC Radio’s NSW Drive show too 😁.

Somewhere in there I also refit my home office into a new filming studio for courses and videos — and tomorrow, Nina (A wonderful woman I’ve worked with for years in another role) joins the Epic Retirement Institute team as our first official permanent team member.

It’s all happening. We’ve got hundreds registered for the upcoming Epic Retirement Flagship Course kicking off on the 28th August and we’re about to shut the Earlybird 25% off and start packing the welcome packs for mailing.

—

And then there’s the big one…. Prime Time: 27 Lessons for the New Midlife lands in stores in just three days. I’m a wee bit excited. (Presales are SO GOOD! I’m honestly humbled).

It’s a book for anyone in their 40s, 50s or 60s who’s ready to stop coasting and start shaping this next chapter — with more clarity, more confidence, and more choice.

If you haven’t already grabbed your copy, now’s the time to pre-order. It means the world to me — and it really helps the book hit the ground running when it launches.

This book is the heart of everything I’ve learned and shared over the past few years. I can’t wait to get it into your hands.

—

Lastly, I’m excited to hold my own first ever free online event. It’s a book launch for Prime Time:27 Lessons for the New Midlife. My wonderful publisher from Hachette, Sophie Hamley will be joining me live online to chat about the book with you - because we both know it intimately and none of you will have seen it. All the details and the free registration link is below! And we’re hosting it on the day the book hits stores — a free lunch and learn! I’ll send out the link to everyone registered this week.

Now go, enjoy your Sunday. And thank you — for everything you consume that I do.

Bec x

Cheers, Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Register here for the Prime Time: 27 Lessons for the New Midlife live online book launch on Wednesday.

To stop retirees going mad, super funds must agree on these three things

Extract of article published in print in The Age, The Sydney Morning Herald, Brisbane Times, WA Today on Sunday 27th July 2025.

Here’s a fun game to play in your last month of work. Log into your super fund and try to find the form to start your retirement income. Now guess what it’s called.

Is it a pension account? A retirement income stream? A “choice income” option? Flexi pension? Super income stream? Or something else that sounds suspiciously like a branding brainstorm that got out of hand?

If you’re confused, congratulations. You’re really normal.

Super funds have spent the past two decades reminding us to save for retirement, making it easy and almost doing the job for us. But when we get to the business end of retirement, where we’re finally ready to spend our super, there’s suddenly a lot to figure out.

It’s at this point that they serve up a jargon soup which makes little sense to anyone outside the finance department, made more confusing because a lot of the terms cross over with language that is used to describe government payments.

Some funds call your retirement account a pension, but you associate the word pension with social security. Some call it an income stream, which makes more sense – if you’ve spoken to an adviser. If not, it’s just a new concept altogether.

What we need is a superannuation dictionary for retirement.

Others go with “income”, just to be vague. A few try to be cute and use all three, switching between “pension” and “income” and even adding in the wider term “account-based pension” just as you’ve finally worked out what the first one meant.

The only thing they seem to agree on is that none of them should use the same words as each other, or, helpfully, as the government.

(READ ON… my articles are never paywalled for Aussies in The Age, The Sydney Morning Herald. )

Solo travel has exploded in popularity - especially among women over 50. But if the words “solo travel” still conjure images of dining alone with a sad sandwich or battling awkward silence in a hotel room for one… this episode will change that.

I’m joined by veteran travel industry leader, sabbatical queen, and travel podcast host Fiona Dalton, who’s here to bust myths, drop brilliant tips, and make the case for why solo travel might just be the greatest gift you can give yourself in your Prime Time. Fiona is an experienced solo traveller herself - and tells some great home truths you can learn from.

We cover everything from travel formats and solo supplements to those weirdly intimidating solo dinners - and Fiona shares her own inspiring stories from biking NZ to driving Scotland to road-tripping the fjords of Norway.

LISTEN TO THIS EPISODE OF THE PODCAST HERE:

I did the Epic Retirement course earlier this year and thought I understood what to do with my Super when I retire.

So I tried contacting AusSuper to move to the 'retirement phase' and firstly they ignored me. When I waited more than 50 minutes on the phone (3rd attempt to contact them) they completely confused me with different names I was not familiar with. I asked to speak to a second person because the first person really didn't know what they were saying and couldn't explain it to me in any other way.

The second person gave additional advice (conflicting with the first person I spoke to) and used different terminology from the first person. So after over 2 hours I'm more confused than ever!

I filled in the survey and said I still needed help and no-one has bothered to contact me!!

Should I just remove my balance and go to a different Super organisation? One that can actually help me.

Oops! We must live in different bubbles. I don't know anyone who uses chatgpt.

And I don't know how to use it. Is it a website? Is it an app? Of course, I have heard of it.