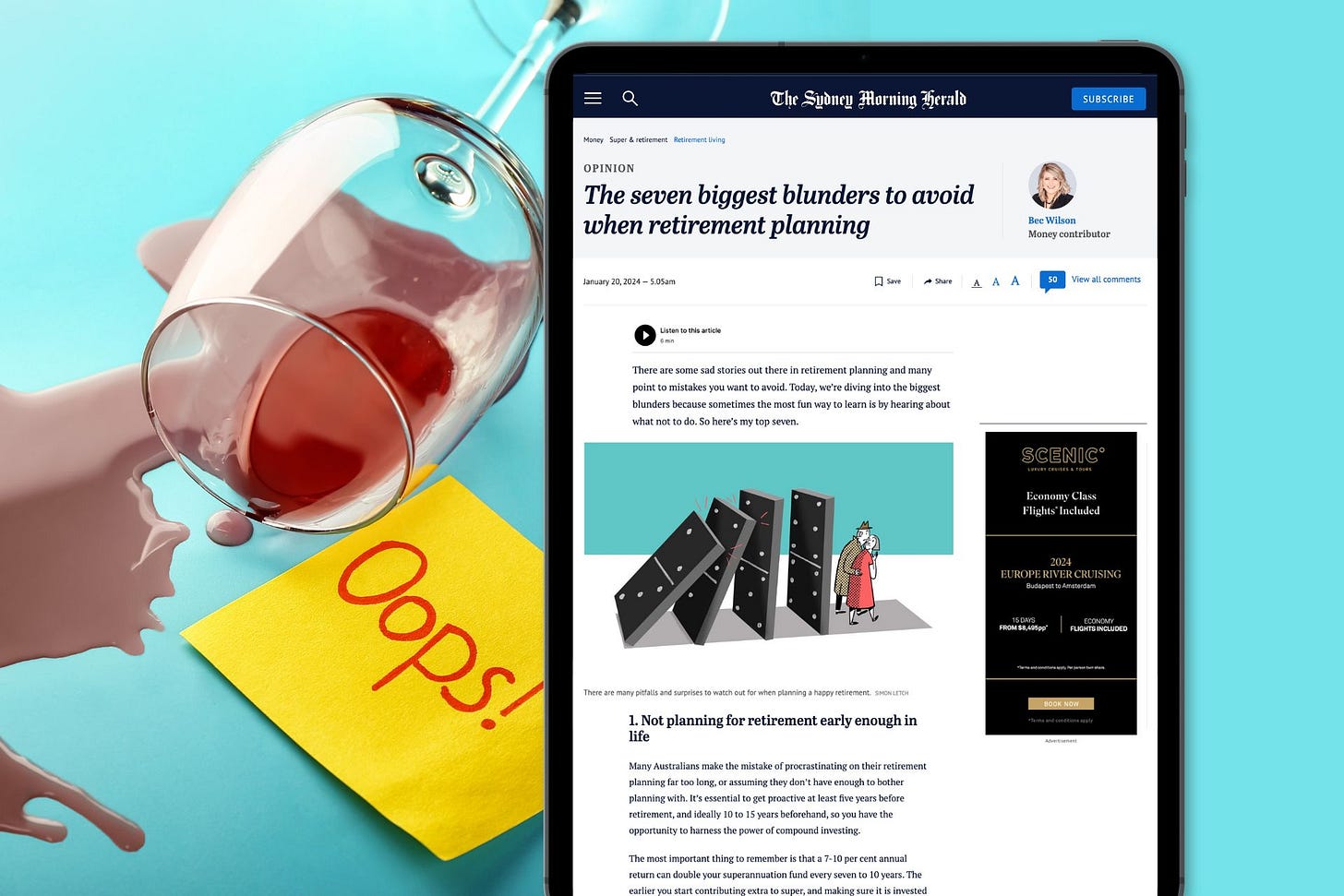

The seven biggest blunders to avoid when retirement planning

Today, we’re diving into the biggest blunders because sometimes the most fun way to learn is by hearing about what not to do. So here’s my top seven.

In this newsletter

Big Epic Retirement and Prime Time news worth celebrating!

This week’s column featured in The Age, The Sydney Morning Herald, Brisbane Times & WA Today.

The Prime Time podcast: How to beat relevance deprivation syndrome with Jim Kilkenny

I’ve got some exciting news! The 2023 book sales data is in, and How to Have an Epic Retirement has come out on top!

It is the #1 bestselling retirement book for 2023!

And, perhaps even more exciting, it is the #2 bestselling book in the category of ‘money and consumer issues’ by an Australian author behind the legendary Barefoot Investor.

If you haven’t already, you can order your copy here… or buy it wherever you buy books.

And, just a day later, the Prime Time podcast has ranked in Apple’s ‘Top Shows’, at #149, on just episode 12. That means a lot of you are downloading the podcast and listening to it! That’s the last episode of season 1!

Season 2 kicks off next week - sign up to get notified.

I want to say thanks to everyone who has bought the book, gifted it to a friend, written a review, or helped to spread the word!

And another big thanks to everyone who’s listened to the podcast - or told someone about it - and subscribed to receive our regular episodes via your podcast app and information via our newsletter at primetimers.net!

We are inviting expressions of interest from sponsors and/or advertisers for the podcast and the Epic Rertirement newsletter. If you’re keen - just email me (reply to this email) and we can chat about it! We have some rather cool packages mapped out.

Now, let’s get on with today’s article!

Many thanks! Bec Wilson

Author, podcast host, columnist, retirement educator, and guest speaker

Each weekend I write a column in both the print and digital editions of The Age, The Sydney Morning Herald, Brisbane Times and WA Today money section. This article was first published here.

There are some sad stories out there in retirement planning and many point to mistakes you want to avoid. Today, we’re diving into the biggest blunders because sometimes the most fun way to learn is by hearing about what not to do. So here’s my top seven.

1. Not planning for retirement early enough in life

Many Australians make the mistake of procrastinating on their retirement planning far too long, or assuming they don’t have enough to bother planning with. It’s essential to get proactive at least five years before retirement, and ideally 10 to 15 years beforehand, so you have the opportunity to harness the power of compound investing.

The most important thing to remember is that a 7-10 per cent annual return can double your superannuation fund every seven to 10 years. The earlier you start contributing extra to super, and making sure it is invested well, the more you will benefit, passively.

2. Not developing interests outside work

Retirement isn’t just about hanging up the work boots; it’s a chance to enjoy a whole new phase of life and lean into the things that bring you real joy in life.

The years leading up to retirement, the prime time of your life, is the ideal time to build a portfolio of things that you are passionate about, new pursuits or hobbies, epic holiday plans, a greater focus on your health, purposeful work projects and quality time with family and friends.

Focusing solely on your career or job right up to retirement can lead to a feeling of relevance deprivation after retirement. And that is avoidable.

3. Retiring too early

So many people jump the gun on retirement, underestimating the financial and psychological impacts. Retiring early might seem enticing or even like the stereotypical dream, but it often leads to financial strain and boredom, and quite frequently these people find their way back into the workforce later.

Extended life expectancy means retirement can span decades, so I dare you to consider a much longer period of pre-retirement, where you experiment with part-time work and part-time retirement.

4. Underestimating their real cost of living

We all like to tell ourselves that we’re spending less than we are. And it’s not until we build a budget from our actual bills and expenses and project forward that we can recognise just how much we need to cover our desired living expenses in retirement.

Many people leave out expenses that might not be incurred rhythmically, but can have an unforeseen impact, like sudden needs for an increase in healthcare or allied health spending, or a critical need for home or car maintenance. I suggest that people practise living on their projected retirement budget – and see how they go for a month. It’s an eye-opener.

5. Withdrawing all their superannuation when they retire for dumb reasons

This one blows my mind. The fundamental purpose of superannuation is to serve as a financial nest egg, ensuring a dependable income stream throughout retirement.

Understanding the concept of compound investing is crucial when we talk about it. For most people, 50-60 per cent of their total returns come from superannuation during their retirement years.

Drawing it all out as a lump sum runs counter to the very essence of superannuation’s designed purpose, and it certainly sees those people missing out on a lifetime of earnings unless they have a real strategy behind their decision.

There’s two more points to read - and you can read them on The Sydney Morning Herald or, The Age here. It’s usually free to access the article - you may need to register.

This week we talk about relevance deprivation syndrome, in a very personal way that many people will be able to relate to.

Jim Kilkenny dived out to the workforce at the age of 56 after a very big career in financial services, having been a financial adviser, business owner and company director. He’d guided thousands of people into retirement over several decades, helping them find both financial stability and understand the need for a sense of purpose. So it was a huge surprise when he stumbled into his own retirement, finding himself feeling irrelevant and lost just months after finishing up work.

We call this ‘relevance deprivation syndrome’ and today we have a long talk about how it feels and how you can identify it, navigate it and even potentially avoid it.

Listen now

LISTEN HERE - LATEST EDITION (S1E12) - OMNY

or listen on APPLE PODCASTS